You can download the Portfolio Analyst Pro 20241202.1 from the link below…

Summary

If you are a trader looking to improve your portfolio management, Portfolio Analyst Pro is a tool designed to help you achieve the highest net profit while managing your draw-down ratio effectively. This software works by combining Tradestation reports and Multicharts reports, allowing you to automatically choose the best portfolio using criteria like energy systems, crude oil systems, and long only systems. The auto portfolio selection feature ensures that the system selects the best combination for maximizing profits and minimizing risks. With the addition of Monte Carlo analysis, you can evaluate various scenarios to better understand potential outcomes.

The Portfolio Analyst Pro comes with a free trial to help you test the system before committing to the full version. It also supports various formats such as XML, CSV, HTML files, and MHT to ensure compatibility with your existing tools. For just $29.95, you gain access to the software along with free upgrades and support from Rellik Software, ensuring you get the most out of your investment. However, be cautious when downloading cracked versions, as they may contain viruses and compromise your system security. It’s always better to buy the software directly for reliable support and updates.

Crack proof

Initial Capital

When determining initial capital for trading, it’s important to understand how to balance equity allocation and margin requirements. Many traders use fixed capital to manage their trades, but others prefer dynamic margin, which adjusts based on the system’s trading behavior. For example, when you use leverage allocation in your trading systems, you are essentially borrowing funds to trade more than your account balance. This can significantly increase your chances of winning trades, especially during big moves in the market, but it also exposes you to a higher risk of losing trades.

Having a clear plan for capital allocation is key to success. A good rule to follow is that the cumulative max drawdown of each system should not exceed 4x the cumulative max drawdown for overall portfolio risk management. This helps manage margin risks while ensuring that you are not over-leveraging. In my experience as a trader for over 17 years, the best approach is to consider trading systems that allow you to manage trading risks by adjusting margin based on systems performance. Balancing the risk of losing with the chance of winning trades is critical to long-term success.

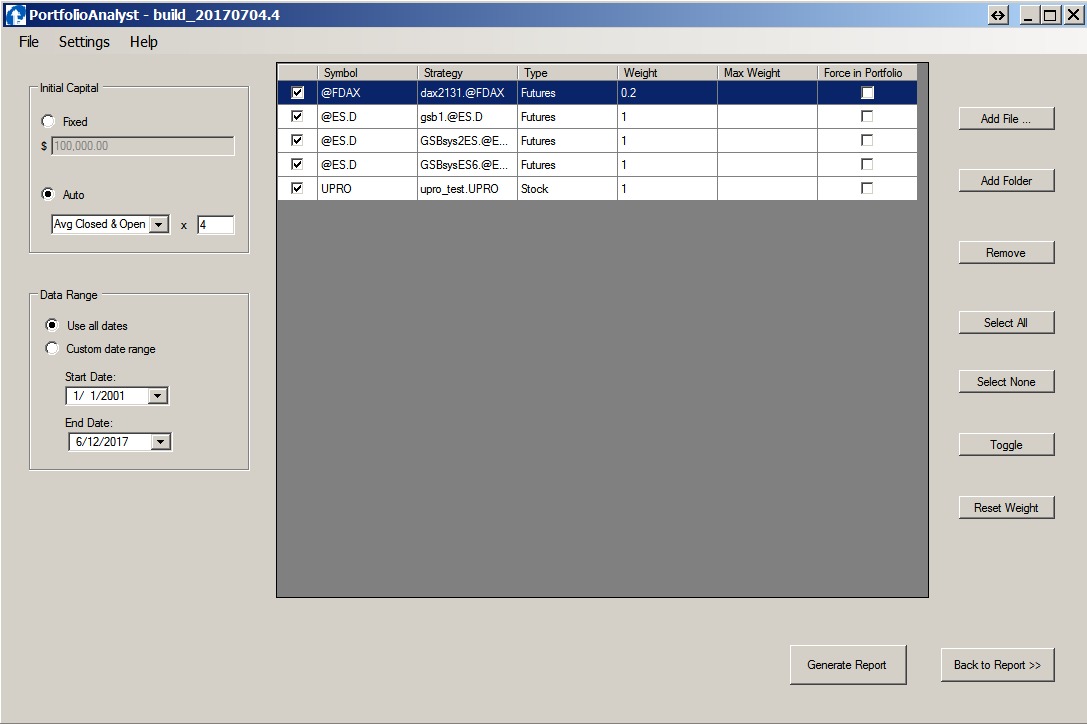

Inputting Files and Folders

When working with Portfolio Analyst Pro, managing your files is simple. You can easily Add File to the system or even Add Folder to upload multiple Portfolio files at once. If you need to manage your selections, use the Select All option to quickly choose all your files, or Select None to de-select everything in one click. You can also Toggle between selected files and non-selected files. If necessary, you can Remove any file or reset Weight for a selected PA File to fine-tune your portfolio. With these simple options, organizing and managing your portfolio files becomes effortless in the PA system.

Portfolio Selection

- When choosing a portfolio, it’s important to consider the margin requirements and how they affect your trading system.

- You can set symbol limits to control the weight of contracts and ensure your trading systems are balanced.

- For risk management, using a dynamic margin approach is better as it adjusts for small moves and prevents unnecessary trading failures.

- The cumulative max drawdown helps assess the risk of your portfolio by analyzing the worst-case scenario over time.

- A good rule to follow is the 4 x cumulative drawdown, which sets a reasonable risk threshold for your portfolio.

- Margin management plays a huge role in controlling trading risks and ensuring your net profit doesn’t get affected by losing trades.

- Use the max weight feature to ensure no system gets overexposed, limiting your risk and improving trading system performance.

- The Sortino ratio is an important metric to track, as it focuses on the negative side of trading risks and helps optimize net profit while minimizing losses.

- Incorporating Monte Carlo simulations and focusing on the net profit to drawdown ratio allows you to better predict how your portfolio will perform under different market conditions.

Specifications

Here are the key specifications for Portfolio Analyst Pro:

- Release: August 23, 2024

- Latest Update: August 23, 2024

- Version: 2.0.90

- Platform: Windows

- Operating System: Windows 11

- Total Downloads: 1

- Downloads Last Week: 0

This tool is currently optimized for Windows users, particularly those with Windows 11. It has the latest version 2.0.90, which was released and updated on August 23, 2024. If you are looking for the latest updates or trying out a tool for your trading strategies, this might be a great start.

Our Paid Service

If you want to Purchase Cracked Version / KeyGen Activator /License Key

Contact Us on our Telegram ID :

Join Us For Update Telegram Group :

Join Us For Update WhatsApp group:

Crack Software Policies & Rules:

Lifetime Activation, Unlimited PCs/Users,

You Can test through AnyDesk before Buying,

And When You Are Satisfied, Then Buy It.